When Diamond Aircraft surprised the 2002 Berlin airshow with an out-of-the-blue new twin powered by a pair of converted automotive diesel engines, there weren’t many visible reasons why it should succeed and a lot of reasons why it couldn’t. The twin market was flat. A new engine married to a new airframe can be the shortcut to disaster and no modern engine maker had commercially converted gasoline automotive engines for aviation use. A diesel conversion? Are you kidding?

A decade-and-a-half later, Diamond’s DA42 still sells, albeit at a fraction of the production volume it once enjoyed. And the factory that built the diesel engines, the former Thielert Aircraft Engine company, now owned by the Continental Motors Group, itself a subsidiary of the Chinese AVIC International, is still perking along.

Even before AVIC injected badly needed capital into the insolvent Thielert works last year, the landscape for the diesel maker had shifted. In 2006, it was booming, thanks to high demand for the DA42. But two years later, it was bankrupt and in 2009, the entire industry tanked, taking sales of aircraft diesels with it.

Although the volume hasn’t recovered, the diesel manufacturing at Continental’s plant in St. Egidien, Germany, sustains. When I visited the plant early last summer, it was building a couple of new engines a day and with spares, ramping up the volume. To its credit—and perhaps the credit of German bankruptcy laws—the plant never stopped building engines and parts, even if customers weren’t always happy about the prices. Today, the infusion of new capital has charged the factory with new energy; there’s money to resume technical projects, a new six-cylinder diesel is in testing and Continental is aggressively pursuing the

modification and conversion market. The factory is geared to build 2000 engines a year; it’s simply waiting for the demand to materialize.

Good Start, Rocky Finish

What is now the Centurion diesel engine began life around 1999 as the Mercedes-Benz OM668, a state-of-the-art automobile diesel engine. Thielert Aircraft Engines, which had expertise in high-performance automotive and racing, converted the engine for aviation use by developing a clutch and gearbox system and modifying various components, mainly the fuel system and related hardware, to be more suitable for Jet A.

At the time, the all-aluminum OM668 was the lightest diesel available and even with the addition of the gearbox, it retained a power-to-weight ratio suitable for light aircraft, although it was still heavier than an equivalent gasoline aircraft engine. The engine, which became the TAE-125, had good enough fuel specifics to offset its weight. Despite the daunting regulatory barriers, by 2001, Thielert had the first modern aircraft diesel certified and Diamond found demand for the DA42 as a trainer and some demand for a single-engine version, the DA40-TDI.

The earliest iteration, the Centurion 1.7, was still largely a Mercedes engine. MB was casting blocks and heads in aluminum and the engines were arriving at Thielert’s factory complete, where they were modified with the gearbox and fuel components. Out of the box, the engine—which was expensive to manufacture and reconfigure—had only a 1000-hour replacement cycle, which Thielert pledged to eventually extend to 2000 hours. (Twelve years later, it’s still limited to 1500 hours, but may soon rise to 1800 hours.) Moreover, the Centurion had an onerous 300-hour gearbox inspection and replacement cycle, which has only recently been doubled to 600 hours.

Thanks to sales by Diamond and some conversion projects, Thielert did we’ll with the Centurion 1.7, at least by 2005 standards, and the engine evolved into the improved 2.0 and eventually the 155-HP 2.0S, which Cessna planned to use in a diesel Skyhawk it announced in 2007.

But by then, Thielert was in trouble. Although the engines had teething problems, the core engine, according to tech sales director Niels Mundt, who joined the company at the beginning, was sound and performed well. In supporting the inspections and gearbox replacements with overbroad warranty support, Thielert had simply constructed an economic house of cards complicated by management and stock irregularity issues when it went public in 2006. The cards folded in early 2008, ahead of the financial crisis that devastated the rest of the industry later that same year. Fortuitously for Cessna, it bailed on the Skyhawk project ahead of the fall and Diamond, Thielert’s largest OEM, eventually began building its own diesel engines, the Austro AE300.

AVIC Buy

The original company remained in bankruptcy for five years, during which time little R&D was conducted and funds were even lacking to field an improved gearbox. Other companies—including Rotax—looked at buying Thielert’s assets, but with its bullish attitude toward heavy-fuel piston engines, the AVIC-owned Continental Motors was the successful suitor, closing the deal in the summer of 2013. Continental had already made a deal with SMA to use its SR305 as base technology for what has become the TD300 diesel, an engine that has yet to find much of a market for SMA or Continental.

The Germany diesel factory is now a division of the re-organized Continental Motors Group. The factory hasn’t physically moved, but due to a tax squabble between neighboring towns, it’s now located in St. Egidien, Germany, rather than Lichtenstein. In the nearby town of Altenburg, at a former East German MiG base, Continental has a new hangar where it does test flight work and assembles kitted engines for the conversion business. It’s clear that both the hangar and the factory are configured for much higher volume. And it’s no accident why they’re where they are.

“This is the traditional machine building area here from the GDR (German Democratic Republic) times,” says Mundt, “so we have a lot of technology here. We have a lot of very specialized companies here with a lot of history.”

That means that the Continental plant has a strong, locally trained workforce to draw on and a number of automotive manufacturers to provide the primary casting, founding, heat treating and plating processes that its low volume doesn’t support conducting inhouse. To a degree, it’s the same model that Continental in Mobile, Rotax in Austria and Lycoming in Pennsylvania follow. All of them outsource some of their manufacturing. But there the comparison ends. Continental’s Centurion plant has much more in common with a modern automotive plant than it does engine building in Mobile.

More than half of the factory is devoted to large primary machine cells capable of building inhouse most of the parts the Centurion engines require. The former Thielert brought in a lot of small-lot and automotive specialty and prototyping work and the new company still does.

The plant specializes in short-run machining of crankshafts. During our factory tour, Mundt showed me a crate full of giant cranks intended for large heavy diesels, stacked next to a cell machining cranks for high-horsepower racing engines. The machinery is modern CNC equipment that’s just now finding its way into other general aviation plants in meaningful numbers.

Large-volume automotive manufacturing supports—and demands—a level of quality control not often apparent in aviation, so when Continental bought Thielert, it got sophisticated metallurgical labs and production quality systems spun directly out of the automotive world. Not many GA manufacturers have scanning electron microscopes in the back offices. In some ways, it’s parallel to what I saw when I toured the Rotax plant in Austria, where the large-volume recreational engine business informs the low-volume aircraft engine manufacturing side.

Just in Time

The automotive influence is no more evident than in the engine assembly area. On my first visit to this factory in 2005, the new engine volume was higher, but the engines were being assembled one-off in individual assembly bays. In 2006, the company invested heavily to install the same kind of Alfing production line that Mercedes uses to produce low-volume, high-performance engines in its AMG division.

The Continental line is no more than a few dozen meters long with seven stations. But unlike a moving assembly line with each worker doing a separate task, here, one guy does it all, moving the engine from station to station on a production trolly. It’s deliberate work, but it moves right along, with the engine and assembler spending about the same amount of time at all the major stations.

Most manufacturing these days uses the Japanese-developed kanban system relying on just-in-time inventory. That means the short Centurion assembly area is lined with bins and shelves containing components. Subassemblies such as pumps, oil filter carriers, alternators, cylinder heads and the like are built separately and placed on angled shelves or carts for the assembler to grab when he needs them. In the automotive world, just-in-time literally means that. Inventory is measured in minutes because manufacturers have learned that piles of unneeded parts erode profitability. It’s a nice theory, but one that’s continually frustrated by the low volume in aviation.

Says Ken Suda, general manager at the St. Egidien plant: “In order to be visible to automotive suppliers as a potential customer, you need to order a certain volume. Once you can order that volume, you can make use of the benefits and that means you can have a very high-quality product at a relatively low price.”

But it also means ordering and inventorying larger quantities than are needed, “ordering against forecast” as the supply chain guys might say. The inventory chews up the volume savings and runs counter to just-in-time supply. Suda says the challenge is to get the balance right and sometimes that means cutting back on other inventory. This is but one minor example of how aviation’s low volume makes it ever more expensive and complex to manage in manufacturing.

Although the tort environment in Europe is less worrisome for manufacturers than it is in the U.S., many automotive suppliers simply won’t build parts for aircraft engines. “And we still have to pay for the insurance policies,” Mundt says.

The Basic Build

If the Centurion began life as a converted automotive engine, Continental says it is now an aircraft engine. When Mercedes abandoned aluminum cases in 2005, Thielert had its own aluminum castings designed and manufactured. Now, Continental either builds all of the engine parts it needs inhouse or sources them through automotive manufacturers. “This is no longer an automotive engine. It is all by us,” Mundt told me.

Suda and Mundt explained that the production line, installed in 2006, was designed with quality assurance built in and I spent part of two days watching it work. Like all engines, the assembly starts with the crankcase and crankshaft assembly at one end of the line. Using bar codes on individual parts and bins, the production system creates a dense web of traceability and is interactive with everything the assembler does. Each tech has his own ID card, which the system matches to each assembly sequence.

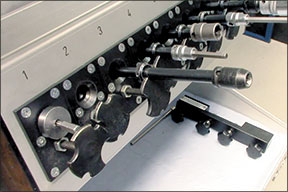

The computer overseeing production knows, for instance, if the right part has been selected and the right number of screws are installed. Electric torque wrenches are automatically programmed at each stage of assembly and they record the torque applied to each fastener. If a tool has to be manually attached to the torque wrench, it’s stored in a locked rack that won’t release the next tool until the previous operation has been completed.

Watching an assembler torque the 10 beefy cylinder-head bolts, I asked how the system monitors the tightening pattern. It doesn’t, Mundt said. The assembler knows the pattern, but a diagram is available if he needs it.

Although the system requires checking off each production step, it can’t know, for example, that the timing chain was correctly installed. For such critical operations outside the computer’s electronic gaze, Continental relies on the so-called “four-eyes” approach that’s standard in the industry; another trained worker inspects the work.

At each step, the assembler has to check off the task on a computer monitor, otherwise, the system red flags until the work is done. If an assembler begins an engine just after breakfast, it’s done and ready for final dressing and wiring just after lunch. Continental figures one skilled assembler can build an engine-and-a-half a day. The current line has the capacity to build 2000 engines a year, based on a single shift. After assembly, the engine goes into the test cell for 90 minutes worth of initial wring-out and break-in, generating more data that lives with the engine serial number for its entire life. It also builds data points to support Continental’s engine life extension program, as it attempts to raise TBRs to 2000 hours and beyond. Speaking of which, with automotive quality and data tracking going into the Centurion engines, when will the TBRs increase, giving the engines the improved economics buyers are looking for?

“We had hoped to have 1800 hours by now. But we want to include some design improvements, so we’re planning on 1800 hours by the end of the year,” says Rhett Ross, adding that the higher TBR will apply to both the 2.0 and 2.0S models. This will substantially reset the economics for Piper’s new 2.0S-powered Archer DX, announced in April.

As for gearboxes and other accessories, Ross said the goal is “half life,” meaning the replaceable items would be replaced only once on the way to TBR. Continental is also exploring a factory overhaul program in lieu of replacing timed-out engines with new. It’s been doing that for gearboxes for a number of years.

The company continues its integration of operating units and is trying to give customers a one-stop shopping experience that won’t include the impression there’s a Mobile division and a Germany division. The Germany factory, for instance, still operates under the Technify nameplate, a holdover from the Thielert days. Ross says Continental would also like to devise sales and delivery methods that would avoid the sting of Euro exchange rates, which many customers complain about.

As we were going to press this month, Continental was preparing to unveil a new 300-HP six-cylinder diesel, again based on a Mercedes design. Although I wasn’t shown this at Altenburg, the engine is about to fly—probably in a Cirrus—and was scheduled to be shown in mock-up form at AirVenture in July.

Ross said Continental will soon drop the Centurion brand and refer to the engines simply as Continental diesels in the 135-, 155-, 230- and 300-HP ranges. The 230-HP version is the TD300, which Continental developed from base technology bought from SMA.

Summary

Although most customers probably don’t realize it, the Centurion diesels—despite some warts, such as short TBRs and high prices—represent aircraft engines manufactured to about the highest degree of quality the industry can support. Low volumes and high variability in aviation continue to frustrate both quality improvement and reduction in prices. In its Centurion diesel manufacturing, Continental has the volume problem, but the infusion of automotive technology appears to have addressed quality issues. Nor does it lack for efficient capacity.

Rhett Ross is blunt about this: “We are facing a reality, which is we have more engine capacity than the entire current and projected global market could ever command. So we have to actively modify our business model from being active manufacturers of piston aviation engines to manufacturers of piston aviation engines and other common products.” That means the factory’s capacity will also be devoted to other kinds of engines and products of the sort I saw on my visit.

In touring the factory and speaking with Continental executives, my conclusion is what this company most desperately lacks is what it cannot control: strong, predictable demand not just for diesel engines, but for all GA products. Piper’s recently announced Archer DX (see July 2014 Aviation Consumer) is a start, but Continental still needs more market outlets for its engines. This remains elusive.

In 2000, diesel looked iffy, at least diesel based on automotive technology. More than a decade later, if Thielert/Continental (and Diamond) have proven anything, it’s that this technology is a survivor even in the worst of business conditions. When—probably not if—the market turns upward, Continental is poised to build a bunch of them.