Although we didnt expect to see it, that great summer sweat-fest that is EAA AirVenture yielded some powerplant developments that were both eye catching and encouraging. (And neither did the sweat materialize; Oshkosh was unseasonably cool and dry for the entire week-at least by our standards.)

We saw three significant developments that are worthy of note: Lycoming came out of the ground with not just a new engine, but an entire suite of new developments that represents a fundamental sea change for a company that has been technologically somnolent for at least a decade.

Diamond says its serious about its Austro engine project and it meant to show it with a production mock-up of the new AE 300, which its driving forward to certify in Europe before the end of the year. Austro is essentially looking to become the next Thielert-but without the financial implosion-and its doing so at a breakneck clip. We got our first detailed look at the engine.

Last, Rolls Royce showed up with the dream engine everyone wants but no one could ever seem to build-the under-200-pound turboshaft engine with efficient fuel specifics and about 400 HP. Have we died and gone to heaven, or are we just hallucinating again?

Lycoming

Some months ago, we opined on the obvious: Lycoming needs to overhaul its long-in-the-tooth engine line in general, but specifically the IO-540 series, whose fuel specifics don’t match the competition from Continental and whose rough running has been the source of more than the occasional complaint.

We also noted that this is no easy task, not so much from the technical standpoint, but as a business decision. New cert products are expensive and on the engine side, OEMs have shown an understandable reluctance to embrace even incremental changes in tried-and-true engine designs unless they appear to deliver compelling benefits. The OEM community has all but rejected Continentals PowerLink FADEC introduced a decade ago. Only one company, Liberty Aerospace, is using it. With great fanfare, engine giant Rotax, under the Bombardier flag, introduced a pair of technologically advanced V-6 powerplants in 2003. It found no takers and the project seems to have sunk without a trace.

But Lycoming is no Rotax and its initiatives revealed at OSH are nothing if not bold. In what appears to be round two of TCMs FADEC idea, Lycoming showed us IE2, a fully electronic engine based on the IO-540, but, if successful, will migrate to its other models as well. The IE2 is as close to a clean sheet engine as

youre likely to see in the current market and it carries a new type certificate as the TEO-540-A1A. The version we looked at is a 350-HP engine with twin turbochargers, electronic ignition and single-lever control, with electronic prop control.

Lycomings chief engineer, Mike Kraft, told us the TEO-540 retains the basic Lycoming power units and cylinders as we’ll as the same crankcase and crankshaft. The cylinders have been modified slightly to accept knock sensors. Its induction piping has been redesigned to accommodate automotive-style timed-pulse fuel injection and the rear accessory case has been entirely reworked. There are no mags on the back of the engine; instead, it has crank and cam position sensors to tell the ignition when to fire. The ignition is powered by a permanent magnet alternator with ships battery for redundancy.

The IE2 is a fully closed loop control system, Kraft says, which treats each cylinder as an individually controlled power unit. This may address-at least we hope-the tendency of the 540 series to run rough compared to the Continental 520/550 powerplants. Because the industry seems to be tilting toward the idea of either mogas or a lower octane aviation fuel, the TEO-540 has something new in aircraft engines: acoustic knock sensing that presumably retards timing when it detects the onset of detonation.

Knock detection has proven problematic in aircraft engines previously because the hash of ambient noise and vibration tends to render them deaf. Kraft concedes the point, but explains that Lycoming has addressed this through “virtual sensors” and inferential software filtering that compares parameters other than just acoustically sensed knock to tamp down detonation.

Compared to Continentals 550s, the Lycoming 540s are not as fuel efficient in real world ops. TCM engines will happily run lean of peak, delivering fuel specifics as low as .38 to .40 pounds of fuel per horsepower hour. But because Lycoming has steadfastly opposed lean-of-peak ops and possibly due to induction

mismatching, the best 540s run at BSFCs above .40 and as high as .44. With avgas averaging in the mid $5 range, but much higher in some areas, fuel efficiency now matters.

So, will the TEO-540 run lean of peak? Kraft says it will, but that the engine will be configurable to meet OEM specs-in other words, its up to the aircraft manufacturer. With the Cirrus SR22s turbonormalized IO-550-N as the poster child for high-power-output efficiency, we think buyers will be reluctant to settle for conservative operating parameters that allow lean running only at low power settings. We know, for example, that Cessnas Jack Pelton has expressed a strong interest in lean run engines because customers are demanding it.

New LSA, IO-390

Lycoming surprised us with two other initiatives, both of which make business sense to us. They displayed a new IO-233 for the LSA market based on the venerable O-235. The engine has throttle body injection and e-mags and has been lightened by about 40 pounds. Although fuel efficiency isn’t as critical in the LSA segment, the injection and its redesigned bottom-up induction should still improve it.

Presently, Rotax owns the LSA powerplant market, but Lycoming has discovered-as have others-that there’s some resistance by shops in maintaining the Rotax engines. They arent especially difficult to wrench, but are unfamiliar to many shops who naturally tilt toward what they know-Lycoming and Continental. In its IO-390 engine, Lycoming has the rarest of opportunities-the chance to market a new certified engine thats already thoroughly tested. Since it launched in 2002, the IO-390 has been a strong seller among homebuilders and, logically, Lycoming will offer it in a certified version under an STC program called Echelon. It plans to start with Cardinal conversions and expand into other models using the O-360 series engines, which represents a substantial market. The IO-390 (210 HP) will be certified later this year. No prices have been announced yet.

Rolls

From out of left field came Rolls Royce with a diminutive turboshaft engine that Mooney says it would like to try in a new model and it promptly signed an agreement with Rolls to do just

that. The RR500 is a multi-fuel (heavy fuel, that is) engine capable of 350 to 450 shaft horsepower. Its intended as a replacement engine for light GA helos and fixed-wing aircraft and is actually an offshoot of the RR300 Rolls developed for the Robinson R66.

Ignoring the price of the engine for a moment-were guessing about $200,000-the RR500 is touted as being as efficient as a piston engine.

Well, not quite. Performance data handed out at the show indicated that the RR500 will run at about .59 BSFC in economy cruise. Thats excellent for turbines which, heretofore, have guzzled along in the mid-sixes, but its no match for the TSIO-550 Mooney already uses in the Acclaim, which is easily capable of .40 BSFC.

Still…the RR500 pencils out as doable in the Mooney for a couple of reasons. One, at 250 pounds installed, its lighter than the Continental engine by at least 220 pounds-a huge Delta. Thats enough saved weight for 33 gallons of fuel-if Mooney can find a place to put it in the airframe. (And if it can make the nose long enough to offset the weight shift.) At economy cruise, Rolls predicts a fuel burn of 24 GPH. The Acclaim can already carry 130 gallons in long range tanks, so allowing for climb, a Rolls Mooney looks like a four-hour airplane to us at…250-plus knots? Nibble the fuel burn back a little with de-rating and add maybe 20 gallons of fuel and you can begin to see how it could work. Then there’s the aftermarket in Cessna 210s, Saratogas and twins. This project may have legs.

Austro

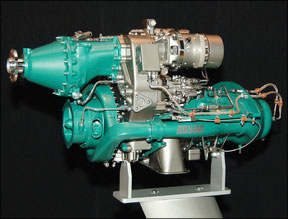

One project thats being forced to run before it can crawl is the Diamond/Austro replacement diesel engine for the ill-starred Thielert Centurion series. This one reminds us of the building of the Pentagon, where the draftsmen were rushing drawings to the site just behind the masons and iron workers having erected it. Diamond is desperate to prove that this project is real by getting the engine certified before the end of the year in Europe.

It looks real enough to us and we took a long critical look at the production mock-up on display at OSH. It looks a little bigger and little heavier than the Thielert, which makes sense, since it delivers 170 horsepower to the Thielerts 135. It also appears to have a more aggressive mounting angle, perhaps to fit a higher engine into the DA42s nacelles.

The eye is immediately drawn to the Austros gearbox-its massive, as we’ll it should be, for the engines success may revolve around how those gears perform. Austro has done away with the Thielerts cranky clutch and replaced it with a torque isolator. The idea is to eliminate the 300-hour gearbox inspections that have all but tanked the economics of the Thielert engines. Diamond tells us the Austros fuel specifics are at least 10 percent better than the Thielerts. Thats a small improvement, but it pays off big over the life of the engine.

While we have no doubt Austro and Diamond will make this engine work, the danger is that an intense, rushed certification effort will overlook some tiny detail that later explodes and crumps the entire program, just as Thielert did. The market interest in diesel has proven surprisingly resilient, despite the Thielert fiasco. It may not have the stomach for another false start.