Diamond Aircraft CEO Christian Dries is nothing if not a pragmatist, albeit an adventurous one. At April’s Aero in Friedrichshafen, Germany, he showed both sides of the same coin when he announced three new single-engine piston models, one powered by an untried new gasoline engine from Lycoming. The latter even he concedes is an admission of sorts. The diesel engines Diamond has championed for 15 years haven’t fared we’ll in the high-performance single-engine market simply because the power options haven’t been there.

But Diamond is hardly giving up on Jet A-burning piston singles. The new models Diamond announced all have diesel engine options and, as if to show Diamond hasn’t lost its nerve, one of the engines is entirely untried and one, SMA’s four-cylinder SR305, is we’ll known but largely unproven for lack of wide market acceptance.

Diamond’s product rollout is significant on several counts. For one, it represents confidence in what is undeniably a moribund market and it signals Diamond’s intent to go head to head against Cirrus with new airframes. Moreover, these new aircraft give Lycoming more demand for its IE2 FADEC-controlled 540-series engine which, heretofore, has been something buyers have insisted they’ve always wanted while OEMs have been just as insistent in not offering it.

Expanding the Line

Diamond’s Dries told us that the new models actually comprise one airframe in two variants and three models, all to be designated DA50s. The DA50-IV will be a four-place airplane powered by the Safran/SMA SR305-230E, a 230-HP four-cylinder diesel. It will be pitched at the training market to compete against the Cirrus SR20 that has found some success as a trainer. Besides the diesel’s fuel economy, the DA50 offers a larger cabin than both Diamond’s own DA40 and the SR20/22.

“We lose one or two contracts each year against Cirrus because they say in a Cirrus airplane, I feel much more comfortable. Particularly in North America, flight instructors, at least a lot of them, are not very light. Flight instructors are a big part of the decision making,” Dries says.

The DA50-V will have the same airframe but with an honest five seats, thanks to a wide bench seat behind the two front seats. The -V will be powered by an upgraded version of the SR305 with 260 HP. Dries said the additional power will come from modifications to the engine’s fuel delivery system.

Heavy and Fast

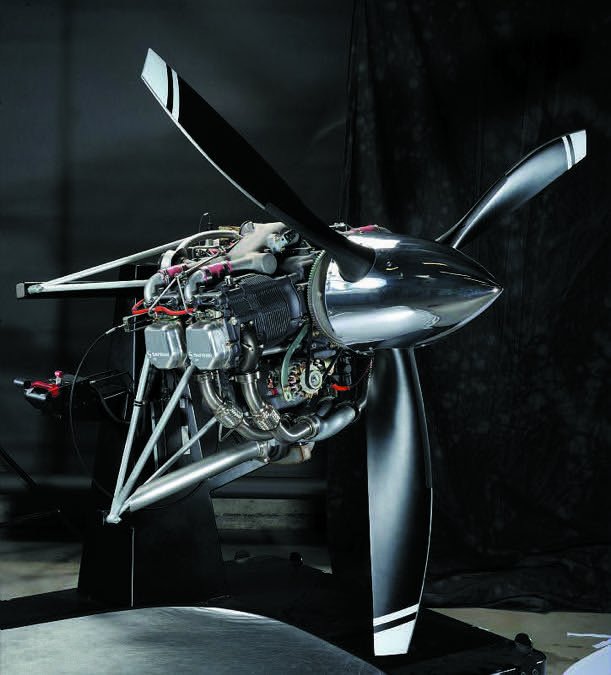

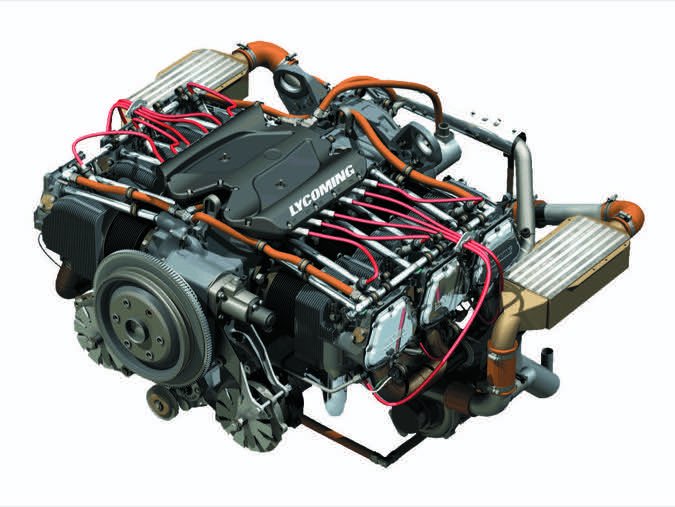

To compete against Cirrus’ top-selling turbocharged SR22, Diamond will offer the DA50-VII, the same basic airframe but one equipped with Lycoming’s new 380-HP TEO-540 six-cylinder engine, with the “E” in TEO signifying electronic. The so-called IE2 engine, which has been under development for almost a decade, is FADEC-driven, has single-lever control and is capable of burning unleaded fuel. However, it still requires 100-octane fuel, presumably the unleaded avgas replacement the FAA promises will emerge from the FAA’s PAFI process next year. The IE2’s most notable OEM customer is Tecnam, with the new P2012 Traveler twin shown at Aero in April. It also has some military applications, specifically the Northrop Grumman Firebird.

The DA50-VII will eventually include a seven-seat option, with two small seats behind the three-person bench, space that would otherwise be devoted to a generous baggage area.

Continuing its commitment to diesel, Diamond will also offer a -VII version with yet another untried engine, the 370-HP six-cylinder SMA SR460. That engine first appeared at Aero three years ago and although it’s at the test-cell stage, it hasn’t flown yet and certification remains in the distance.

While the -IV and -V DA50 variants will be fixed gear, the -VII will be a retractable with cruise performance projected to be about 230 knots. The airplane is the first truly new piston retractable we’ve seen in three decades and will be the most powerful single-engine piston on the market. Diamond’s Dries told us the company’s aggressive 2018 or 2019 certification schedule is realistic because the -VII’s wing center section and landing gear will be lifted directly from the DA62, thus the structures are already certified and proven.

Turbine, TOO

Just in case you’re bored by piston engines, Diamond will also offer a turbine version of the -VII powered by a Ukrainian-sourced engine called the Ivchenko-Progress AI-450S. The engine is a free-turbine design similar to Pratt & Whitney’s workhorse PT6A and was developed by Ivchenko-Progress, a remnant of the old Soviet design bureau structure and manufactured by Motor Sich JSC, another Ukrainian company with more than a century of engine manufacturing experience in both pistons and turbines. The AI-450S has 465 HP with fuel specifics similar to the PT6.

But Diamond’s turbine aspirations aren’t to compete with Piper’s Meridian or the TBM. The AI-450S is a low-altitude engine optimized for, at best, the low teens. In the DA50 airframe, it will likely deliver a heavy hauler suited for regions where neither avgas nor maintenance are available. Diamond first flew the engine in 2015 in a test bed it called the DA50-JP7. Dries said in its current form, the AI-450S is not certified to EASA standards but is expected to be by 2018 or 2019.

While these models may appear to be new, the airframe itself is a reheat of sorts, having first appeared at a surprise Christmas party at Diamond’s Wiener Neustadt factory headquarters in 2006. It was shown in prototype form at AirVenture in 2007 as the DA50 SuperStar. At the time, the planned powerplant was Continental’s TSIOF-550J, Continental’s version of an electronic piston engine that predates Lycoming’s effort. But the SuperStar was not to be, tanked both by Diamond’s travails with the then-Thielert Centurion diesels and later the global economic downturn in 2008. Nonetheless, Diamond’s effort on the project was work to the good; the larger airframe morphed into the DA62 twin, which is seeing brisk sales success and refinement on that airframe will definitely inform the resuscitation of the DA50.

Bold or Nuts?

When Diamond announced the DA42 twin in 2002, it mated completely untried engines—the Thielert Centurion diesels—with a new airframe, a two-fanged risk that more cautious aircraft manufacturers have avoided. It paid a steep price when the engines proved tender and ran into maintenance and reliability issues. After the fact, Dries vowed that he would never repeat the mistake and his contentious relationship with Thielert led him to found his own engine company, the Austria-based Austro.

Isn’t he potentially repeating the mistake, this time with not just one, but three unproven engines? Dries admits there is risk, but he points out that as far as the Lycoming IE2 is concerned, “Lycoming is the only engine company we have never had trouble with.” Although Continental now owns the assets of the former Thielert Aircraft Engines, Dries says the bad blood runs too deep for him to consider a new engine deal with Continental.

But turning to SMA has its own risks. What’s now the SR305 first flew in prototype form in 1998, but it has proven difficult to both certify and market. In 2012, to jumpstart its diesel program, Continental bought the technology from SMA to develop its own version of the engine. Five years later, it still hasn’t certified the engine nor found a significant market for it. In 2012, Cessna announced an SMA-powered 182, but for reasons we believe are related to the engine, the project has been effectively cancelled. There are a handful of SMA-converted legacy 182s flying, but SMA never seemed enthusiastic about the program. Even Cirrus toyed with the SR305, eventually dropping it because of cold weather starting and operation issues.

Dries told us he’s undaunted by all of this and that because Diamond has more diesel experience than any other OEM, they expect to sort out whatever problems the SR305 might have. As it did with the Mercedes-based Austro engines, Diamond plans to squeeze more horsepower out of the basic SR305 engine platform for the DA50-V. The larger risk might be the six-cylinder SR460, which is still under development and some distance from flight test, much less certification. It’s loosely based on the SR305 in that it’s horizontally opposed with direct drive and has combination air and oil cooling. As does the SR305, the 460 uses the old-school Bosch mechanical fuel injection system, but it incorporates a common rail design. If Diamond gets it flying and certified, it will become the highest power aerodiesel in the market thus far. At Aero, Continental announced that its V-6 diesel has completed testing, but it’s not certified yet. That engine, capable of at least 310 HP, has been flying in a Cirrus and since both Cirrus and Continental are owned by the same Chinese-based AVIC mothership, it seems likely the V-6 is headed for the SR22.

Market Appeal

With sales of piston aircraft essentially flat if not in decline, manufacturers have come to all but abandon the hope of significant market expansion for the foreseeable future, perhaps even to include Asia and Africa.

Cirrus continues to dominate piston sales, with a 31 percent market share in 2016, compared to 13 percent for Diamond, 27 percent for Cessna and 9 percent for Piper.

With its diesel twins popular for training, Diamond owns the twin market with exactly half of all twin sales. “But,” says Christian Dries, “we know from our surveys that a certain amount of people do not consider a twin-engine airplane; about 60 percent. It’s a natural step to develop a new single-engine airplane.”

One sales executive we talked to said Diamond taking on Cirrus was like “kicking an elephant in the shins.” But Dries sees an opening. “With the -VII, with this [Lycoming] engine and 230 knots, I think it will provide customers with quite an interesting airplane,” Dries told us.

He says it will be faster than the SR22, carry more passengers and stuff and offer more comfort in a technologically adept package. Like the DA62 twin, the cabin, at least in the -7, will have configuration flexibility and be able to carry large, heavy loads or more people. The airframes are constructed largely of carbon fiber so they are lighter than the equivalent fiberglass structure and stronger, too. At 4800 pounds max gross, that’s 1200 pounds heavier than a Piper Saratoga and the useful load ought to be impressive.

As a sales point, Dries said Diamond considered offering a ballistic parachute but hasn’t ruled it in or out. The DA50 line will have Garmin’s latest glass-panel product, the G1000 NXi, and possibly some version of autoland technology. Diamond has been developing this in Austria and has demonstrated it on the DA42 twins. Dries hinted that Garmin is working on its own version and it seems likely that this will be the next big thing in avionics, ultimately leading to integrated autonomy in the distant future.

When Diamond trial ballooned the DA50 in 2007, it did so in a different world. That was the most recent peak year in piston sales, with 2675 aircraft sold and a booming economy. Veteran sales executive Fred Ahles, of Premier Aircraft, says Diamond took at least 50 advance orders for the airplane with the appeal being the larger cabin and slightly higher cruise speed over the SR22. Other salespeople have told us there’s a niche of buyers who want the extra seats and cargo-carrying capacity and Cirrus has nothing to offer them, at least at the moment.

“If there’s a better mousetrap than Cirrus, they may not make the pie bigger, but they could certainly take a lot away from Cirrus,” Ahles says. Diamond might eke out additional sales for the DA40 line, which hasn’t seen a major revision since it got the Garmin G1000 in 2003. As the company announced the new models, it was we’ll into moving production between its Austria and London, Ontario, factories.

DA62 production, including composite layup, will move to London, as will all versions of the DA40 single. One model, the DA40 NG, is powered by the Austro diesel and has a higher gross weight to accommodate the heavier engine. London plant manager Peter Maurer told us that refitting that model with the lighter Lycoming could yield a DA40 with higher useful load, giving it an edge against the Cirrus SR20 for the training and personal-use market. While the industry has been touting the revision of FAR 23 to reduce production and certification costs, that won’t apply to the DA50 series, says Dries.

The new singles lift much of their structure from the already completed DA62, so the costs are baked in. That means invoices in the high six figures, says Dries. The DA50-IV, for example, will sell for an estimated $650,000 while the -VII will be north of $800,000. If it’s any less expensive than an SR22, the margin may not be enough to yield significant sales leverage. We’re sure to know more about that when the DA50s begin to trickle into the market next year and into 2019.